Trading Ethereum allows traders to get exposure to one of the largest cryptocurrencies in the world. With a market capitalization of over $300 billion, Ethereum is second only to Bitcoin and one of the major players in the blockchain revolution. Here’s what you need to know to trade Ethereum in 2022.

What is Ethereum

Unlike many of you would believe, Ethereum isn’t a cryptocurrency. It’s a software that is decentralized and that allows programmers to develop all sorts of programs to run on the blockchain.

Ethereum has been built to run applications on the network that are decentralized, secure, protected from manipulation, and much more

In other words, while Bitcoin’s underlying technology is developed specifically for monetary transactions, Ethereum has been built to run applications on the network that are decentralized, secure, protected from manipulation, and much more.

The price that you see for Ethereum actually refers to the token that is used on the Ethereum network, which is called Ether. Ether is a cryptocurrency just like Bitcoin and represents the monetary value of the Ethereum network.

Since its inception in 2013 by Vitalik Buterin, the Ethereum network has attracted a lot of attention from different industries, including finance, real estate, software developers, and even the pharmaceutical industry.

What gives Ethereum value?

The value of the Ethereum value, or rather the price of the Ether token, arises from its versatility and power to run decentralized, secure apps on the network. As more and more people from different types of industries get attracted to Ethereum, its token Ether becomes more in demand and rises in value.

Some of the largest financial institutions in the world, like BNP Paribas, UBS, Fidelity, and Citigroup, are exploring or investing in the Ethereum network and creating promising projects that may soon see the day of light.

Other giants, such as Amazon, Google, Microsoft, and Siemens have also recently entered the blockchain race. Any news of large companies showing interest in Ethereum ultimately leads to more demand and higher prices in the Ether token.

How Ethereum is Different from Bitcoin

There are many important differences between Bitcoin and Ethereum. Bitcoin is arguably the largest and most popular cryptocurrency out there that has managed to attract the largest interest so far. This has also caused the price of Bitcoin to skyrocket. Compared to BTC, ETH is trading around 10x lower.

Ethereum, as mentioned, is not a cryptocurrency. It’s a software, a platform that allows the development of highly powerful and secure apps on a decentralized network. The network is powered by Ethereum’s token called Ether, which is what people who want to jump on the bandwagon want to invest in.

Unlike Bitcoin, the Ethereum network (more precisely, the ETH2 upgrade) uses a Proof-of-Stake consensus mechanism that allows investors to stake their tokens in order to validate new blocks onto the blockchain.

Before this becomes too technical, let’s just say that Proof-of-Stake is more energy-efficient and cost-effective than Bitcoin’s Proof-of-Work mechanism, and investors who invest their coins in “staking” earn daily interest for doing so.

Ethereum is also the underlying network that powers NFTs. An NFT (non-fungible token) is a unit of data stored on the blockchain that can be sold and traded. Each NFT has its own ID on the blockchain. Although copying NFTs is possible, there is always a way to track the source of the original NFT.

Digital files such as photos, videos, and music have reached astronomical prices in the form of NFTs, as each NFT is uniquely identifiable and provides a sort of certificate of authenticity. NFTs have drawn increasing criticism for their speculative purposes and structures that resemble a Ponzi scheme.

Why you should trade Ethereum

So far, you know that Ethereum is a network powered by the Ether token. However, for the sake of simplicity, we’ll just use Ethereum and Ether interchangeably when referring to Ethereum trading.

Ethereum is a major player in the crypto ecosystem. Let’s see how you can trade Ethereum, why you should do it, and what are the main risks you need to look out for.

Diverse development team

Ethereum is an ambitious project with the main goal of building a decentralized computing machine. Unlike Bitcoin’s vision, which is to build a secure and scalable payment network, Ethereum’s ambitions are wider and broader.

This has attracted all types of developers and investors to the Ethereum network, where very interesting projects arise almost on a daily basis. From finance to real estate, Ethereum’s network can be used to run secure and decentralized apps to power the world of tomorrow.

This also means that people with diverse skillsets join the Ethereum network every day and the development on the network is more accessible to newcomers than Bitcoin’s.

The network effect

Ethereum is the first blockchain network with the goal of building a global computing machine that is secure, fast, and decentralized. The network’s capabilities to create so-called smart contracts – pieces of code that automatically execute on the blockchain according to the terms of the contract – gives it a first-mover advantage in the space.

The rising popularity of DeFi, or Decentralized Finance, is another field where Ethereum’s network capabilities excel. Other networks have tried to compete in the same space, but unless they innovate much faster and gain considerable traction, it’s hard to believe that they will overtake Ethereum’s position in the near future.

Acceptance by large companies

Many large companies have recognized Ethereum’s ambitious goal of becoming a decentralized computing machine. As mentioned, this has attracted attention from tech heavyweights like Microsoft, Google, Amazon, but also from major financial institutions like UBS and Citigroup.

Microsoft, for example, has developed an Ethereum-based Coco platform that takes advantage of Ethereum’s decentralized network to provide alternative database structures. Other big companies are following with more interesting Ethereum-based projects that are under development.

Why you shouldn’t trade Ethereum

Despite all the advantages that Ethereum provides to traders and investors, there are also certain risks associated with the network. Here are some of the main reasons why you should be cautious when trading Ethereum.

Hacker attacks

Being in the first place a platform that allows for the development and execution of decentralized apps and smart contracts, Ethereum’s programming is much more versatile than Bitcoin’s which is mostly limited to financial functions.

Unfortunately, this also means that hackers have more options to attack the network. More complexity inevitably leads to more potential problems. Even Ethereum’s smart contracts are not completely bullet-proof and some of them have already failed or been hacked.

Proof-of-Stake risks

Most major cryptocurrencies, including Ethereum, use Proof-of-Work (PoW) mechanisms to verify transactions on the blockchain. In Proof-of-Work, miners around the world have to solve complex crypto puzzles in order to validate new transactions and add new blocks to the blockchain. This is extremely energy-consuming and time-inefficient.

Ethereum has started to move its network to Proof-of-Stake (PoS) to reach consensus across the network, which is a big technical challenge. Proof-of-Stake is based on users who stake their ETH to become a validator in the network and verify new transactions, which is more energy-efficient than Proof-of-Work.

The outcomes of both PoW and PoS are the same – adding new blocks onto the blockchain – but the underlying mechanisms are very different. Ethereum’s transition to PoS can eventually lead to turbulences in the network which can’t be anticipated.

Congestion issues

Given Ethereum’s popularity, smart contract capabilities, and decentralized computation, many new projects are being added to the network on a daily basis. It’s the platform of choice for many new ICOs (Initial Coin Offerings) that aim to take advantage of the Ethereum network once deployed.

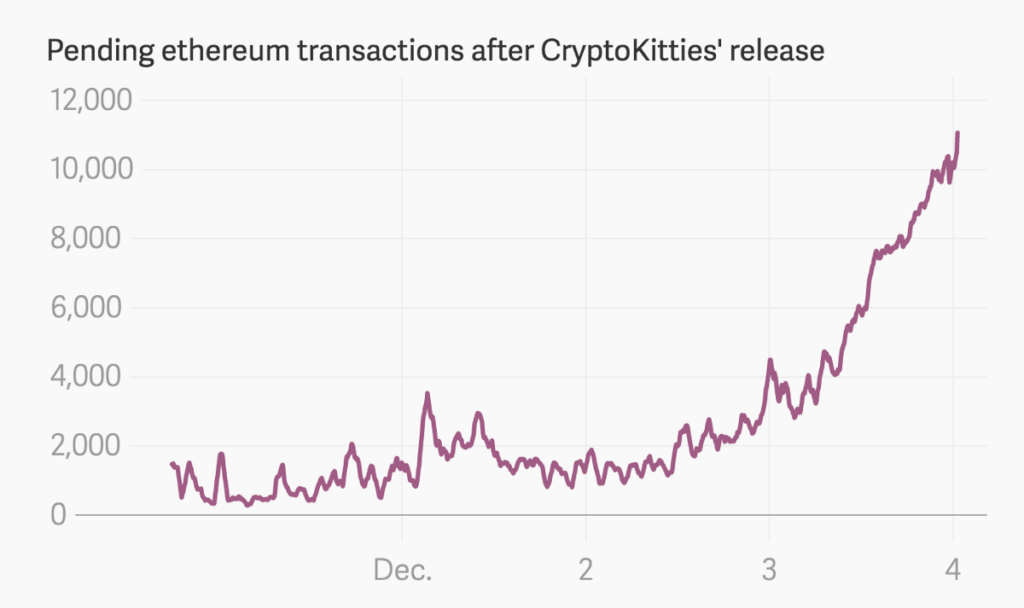

The growing number of new projects on the Ethereum network can lead to congestion issues. In 2017, a fun hack-a-thon project named CryptoKitties, which allowed players to purchase, breed, and sell virtual cats, pushed Ethereum’s network to its limits and caused unprecedented levels of congestion.

At one point, the game’s pending transactions accounted for about 25% of Ethereum’s network traffic, which led to CryptoKitties announcing plans to switch to the FLOW blockchain.

What moves Ethereum price?

While there are many factors that influence the price of Ethereum, it’s helpful to have a general idea of why Ethereum came into existence and what its main ambitions are.

So far, you know that Ethereum aims to create a global decentralized computing machine that runs decentralized apps and uses the Ether (ETH) token to power its network. Ether is a cryptocurrency that the Ethereum project claims to be the “currency for our digital future.”

Alright, so any new project that utilizes the Ethereum network to deploy its functionality can potentially have a big impact on the value of Ether. If you’re serious about trading Ethereum, you need to stay up-to-date on new and exciting projects on the network.

Other drivers of Ethereum include:

- Technological upgrades: Proof-of-Stake, scalability upgrades, and any new functions on the blockchain can impact the price of Ether.

- Mainstream adoption: As more and more big companies start exploring Ethereum and developing their own projects on the network, higher demand can lead to higher prices of the coin.

- Decentralized Finance (DeFi): DeFi apps and new finance projects on the network are becoming increasingly popular.

- Market supply: Unlike Bitcoin, the supply of ETH is not capped. More supply can potentially lead to lower prices.

- Competition: There are many new blockchains that claim to offer better functionalities than Ethereum. However, their popularity is still far behind that of Ethereum.

Where to buy ETH?

Buying ETH – the Ethereum token – can be done in several ways. Here are some of the most popular ones to buy ETH today.

Online stock brokers

Arguably the best way to buy Ethereum online is to use a broker that offers Ethereum trading via CFDs. Contracts for Difference (CFDs) allow you to speculate on rising and falling prices in Ethereum without owning the underlying asset.

Other advantages of CFD trading include leveraged trading, which magnifies your profits by borrowing funds from your broker, and short-selling, which allows making profits during periods of falling prices in the market.

Centralized crypto brokerages (with hosted & non-custodial wallets)

Another way to buy Ethereum is to use a specialized crypto brokerage, such as Coinbase, that acts as a middleman in the buying and selling of cryptocurrencies. Those brokerages are usually highly-specialized and offer a great variety of cryptocurrencies to choose from.

Centralized crypto brokerages (and exchanges) come with hosted and non-custodial wallets. A brokerage with a hosted wallet takes care of your private keys and allows you to seamlessly transact your coins through other means of security, such as two-factor authentication for example.

Many centralized brokerages also allow you to use non-custodial wallets where you have sole control of your private keys. Coinbase Wallet is a non-custodial wallet, but Coinbase.com offers hosted wallets and takes care of your private keys.

A major problem that blockchain enthusiasts have with centralized exchanges is that centralization is contrary to the decentralized spirit of blockchain.

Decentralized exchanges

Decentralized exchanges, or DEX, are purely decentralized platforms that connect buyers and sellers of different cryptocurrencies. They don’t act as middlemen and don’t require any deposits into your trading account in order to buy coins. Instead, with DEXs, you trade directly with a buyer or seller.

How to trade Ethereum

To start trading Ethereum, you’ll need a live trading account first. With an account, a trading plan, and a sound trading idea, you’re ready to place your Ethereum trade. Here are the main steps to follow.

Step 1. Open an account

The first step to start trading Ethereum is to open a live trading account with an online broker. Since most retail traders who aim to speculate on short-term price movements in the coin will likely prefer CFDs, we’ll stick to CFD providers here.

Opening a CFD trading account is easy and straightforward. Fill in the registration form, make your first deposit, and once your account gets approved you can start trading.

Step 2. Develop a trading plan

Trading Ethereum without a well-round trading plan isn’t a good idea. Cryptocurrencies can be extremely volatile at times, and without a trading plan that acts as a roadmap when times get tough, you’ll likely be prone to emotional trading.

A good trading plan includes the following: entry and exit rules for your strategy, trading hours, traded markets, maximum loss per trade, preferred risk-to-reward ratio, and any other metric that you may find useful.

Step 3. Do your research

Once your trading plan is in place, it’s time to do your research. Open up the price chart of Ethereum and check for promising trading opportunities.

Is the price trading around important support and resistance levels? Has the price formed a chart pattern, such as a rising wedge or triangle? Is there any news that could have an impact on the price of Ethereum? Trading without researching the market first resembles gambling and will have a negative impact on your performance.

Step 4. Place a trade

Finally, after you’ve identified a high-probability trading opportunity in the market, it’s time to place your trade. If you think the price will go up, you need to buy Ethereum, and if you think the price will go down, you need to short-sell Ethereum.

How to sell Ethereum

When you buy Ethereum, you’ll want to sell it at one moment. How to sell your Ethereum depends in the first place on the way how you bought it: did you use a centralized exchange like Coinbase, a decentralized exchange, or an online CFD broker?

Selling Ethereum with a CFD broker is as simple as buying it. Simply hit the “sell” button, and you’re finished. If you place a stop-loss or take-profit order with your long ETH trade (tip: always use stop-losses!), your trade will automatically sell after the pre-specified price levels are reached.

Centralized and decentralized exchanges offer a similarly simple way to sell your Ethereum. A centralized exchange, like Coinbase, will match your selling order with an interested buyer, while a decentralized exchange will provide you with the necessary tools to directly find a buyer for your Ether coins.

Why trade Ethereum with Swift Expert Trades

Trading Ethereum with Swift Expert Trades allows you to take advantage of an award-winning trading platform and lightning-fast trade execution. Swift Expert Trades’s powerful charting tools, including trend-analysis tools, technical indicators, and customizable user interfaces, cater to both beginner traders and professionals.

Swift Expert Trades also features attractive leverage ratios for Ethereum trading that can go as high as 100:1. Combine that with ultra-tight spreads and you’ll get the most out of your trading funds.

If you still don’t have a trading plan in place, you can copy trades of other profitable traders with the broker’s Copy Trading module. There are hundreds of traders to choose from, and the broker also offers powerful tools to filter through different performance metrics for copy trading.

What is the best way to trade Ethereum?

Trading Ethereum via CFDs allows you to take full advantage of leverage and short-selling. Other viable options include trading Ethereum through a centralized exchange like Coinbase, or through DEXs.

Is Ethereum trading profitable?

Ethereum is a volatile cryptocurrency with many attractive trading opportunities. Therefore, trading Ethereum can be very profitable if you have a well-round trading plan in place.

How do you trade Ethereum for cash?

You can trade Ethereum for cash using CFD brokers or centralized exchanges. Decentralized exchanges are mostly used to exchange one cryptocurrency for another without middlemen.

How do you trade Ethereum for beginners?

The first step in trading Ethereum is to open a live trading account and to develop and stick to a trading strategy. If you feel like you still don’t have the required skills for trading, you can also try out a copy trading service and follow the trades of other profitable traders.

How much does it cost to sell Ethereum?

When selling Ethereum with a CFD broker, you have to pay the spread, i.e. the difference between the bid and ask price. Swift Expert Trades offers very competitive spreads for trading Ethereum and other cryptocurrencies.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Swift Expert Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Swift Expert Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.