The S&P 500, also known as the Standard and Poor’s 500, is a large US stock market index tracking some of the largest companies that are listed on stock exchanges in the United States. It is a widely followed index that offers plenty of opportunities to those who want to trade the S&P 500.

What is the S&P 500 Index

The S&P 500 index tracks the performance of large US companies, including names like Apple, Microsoft, Google’s parent company Alphabet, Amazon, Tesla, and Nvidia. The Index also includes companies that have increased their dividends in 25 consecutive years, which are also known as the S&P 500 Dividend Aristocrats.

Along with NASDAQ and Dow Jones, the Japanese Nikkei, and the UK FTSE, the S&P 500 is one of the most followed stock indices in the world and is often considered as a health barometer of the US and global economy.

The Index was founded in 1957 and is operated by the S&P Dow Jones. Investors who want to get exposure to the Index have a variety of options at their disposal, such as investing in ETFs that track all constituents of the Index, buying futures and options contracts, or trading CFDs that are tracking the performance of the Index.

What are the listing criteria for the S&P 500?

All components of the Index are selected by a committee, which means that – unlike with some other popular indices – there are no strictly rule-based criteria for companies that want to be included in the S&P 500.

The S&P 500 is a free-float weighted index that takes into account the total market capitalization of its constituent companies.

The S&P 500 is a free-float weighted index that takes into account the total market capitalization of its constituent companies. Among other selection criteria, companies that want to make it to the list must have a market capitalization (stock price x shares outstanding) of at least $13 billion.

However, some important criteria still have to be met. Besides the minimum market cap, companies must have a minimum monthly trading volume of 250,000 shares in the past six months, they must be publicly listed on either the New York Stock Exchange or NASDAQ, and should be based in the United States.

How often do S&P 500 companies change?

In order to remain indicative of the largest companies in the country, the S&P 500 index is rebalanced every quarter by the index committee. Nevertheless, to minimize frequent turnover in the index, companies that experience a short-term decline in their value are often allowed to stay in the index by the committee.

All companies in the S&P 500 are under quarterly review by the committee, and any updates to the index’s constituents are timely communicated within a few days’ notice. Usually, the main changes that are made to the index are the weighting percentages of the constituent companies within the index.

How is the S&P 500 calculated?

The S&P 500 is a free-float index where companies are weighted in the proportion of their market capitalization, that is, the number of outstanding shares multiplied by the current share price. In its calculation, the index disregards shares that are held by insiders or controlled by shareholders that are not publicly traded.

Only the “public float”, i.e. shares that are available for public trading, are used in calculating the current market cap of a company. The capitalization-weighted calculation also tries to minimize the effect of corporate actions on the value of a particular company, such as additional share issuance, buybacks, special dividends, and corporate spin-offs.

Why should you be interested in the S&P 500?

Being one of the most important stock indices in the world, the S&P 500 reflects the current state of the US and global economy and is widely traded by retail traders around the globe. The attractive volatility of the index, as represented by the VIX, means that interesting trading opportunities regularly arise in the market.

The VIX, also known as the volatility index, is a special index that is designed to track the implied volatility of the S&P 500. It does so by taking into account the volatilities of put and call options and calculating the expected future volatility of the S&P 500. When the VIX index rises, traders can expect increased volatility in the S&P 500.

Secondly, following and trading the S&P 500 allows traders to achieve diversified exposure in their portfolios. Rather than owning one single stock, the index allows you to get a broad exposure of the largest publicly-traded companies in the United States.

This feature of the S&P 500 is also very important to short-term traders. Important market reports and news that are closely linked to the performance of the global economy are often immediately reflected by movements in the S&P 500. For example, when US retail sales beat or miss expectations, the S&P 500 will move accordingly to reflect the news.

What does the S&P 500 price mean?

The price of the S&P 500 reflects the rise and fall of the share prices of the constituent companies. This means when the price of the S&P 500 rises, a specific company or a group of companies are rising in value. Conversely, when the price of the index falls, a specific company or industrial sector is experiencing falling share prices.

It’s also worth noting that, since the S&P 500 is a capitalization-weighted index, changes in the share price of more valuable companies tend to have a larger impact on the index price. For example, a change in the share price of Apple Inc. will have a more significant impact on the index price than the change of a smaller constituent company.

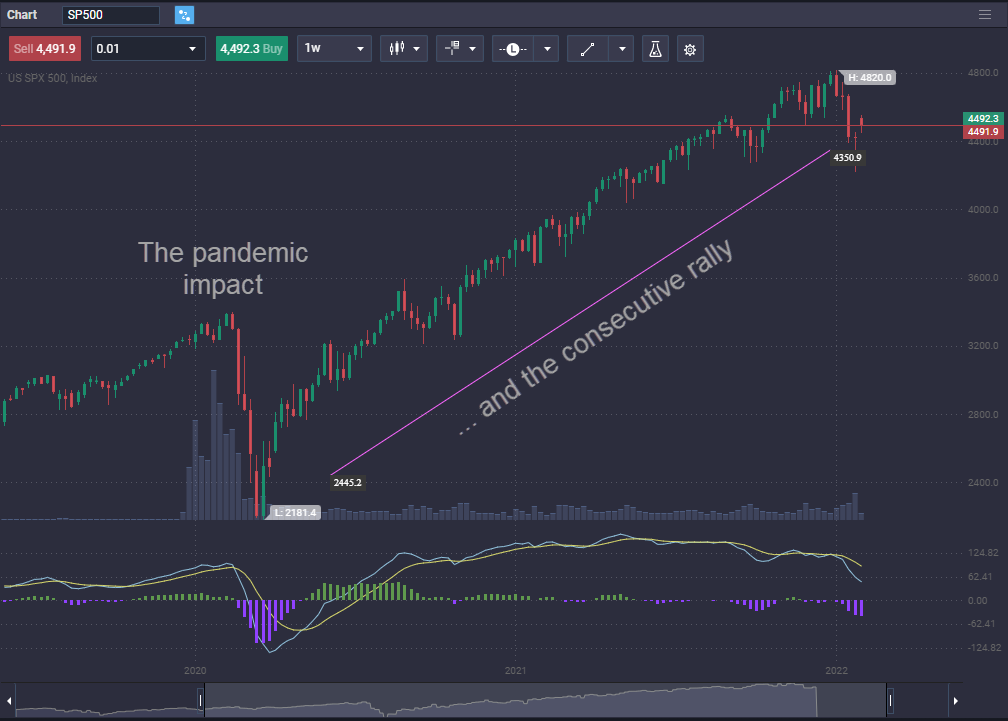

Strong market turbulence can have a huge impact on the stock market in general, which can often lead to a sharp sell-off in the stock market and impact the S&P 500 accordingly. It’s not uncommon for the index price to quickly fall several percentages in times of market stress, as was the case at the beginning of the Covid-19 pandemic.

What affects the S&P 500 price?

There are many factors that influence the US economy and the price of the S&P 500, including fundamental and technical drivers, important news, and market sentiment. In particular, the Federal Reserve can have a long-lasting impact on the index with their changes of monetary policy. Here are the most important drivers of the S&P 500.

Monetary policy and economic releases

Monetary policy decisions by the Federal Reserve are widely followed by traders around the world. Unexpected changes in the interest rates can send shockwaves through the markets and cause extreme levels of volatility in the S&P 500.

Monetary policy decisions by the Federal Reserve are widely followed by traders around the world.

Simply said, when the Federal Reserve hikes overnight interest rates, i.e. tightens monetary conditions, this leads to a domino effect in other interest rates across the economy and makes money more expensive. Companies have to pay more for loans, infrastructural investments fall, and profit margins deteriorate.

This is the reason why higher interest rates, or even expectations of higher future interest rates, negatively affect the share price of companies and cause a drop in the S&P 500 price.

Conversely, when the Federal Reserve lowers interest rates, i.e. pursues an accommodative monetary policy, money and loans get cheaper. Companies start to invest more, consumers spend on more expensive durable goods, and profit margins increase. This leads to higher share prices and a rise in the S&P 500.

Besides monetary policy decisions, economic releases can also have a strong impact on the stock market. When economic indicators show that the economy is doing well, this raises consumer and business confidence and often leads to higher prices in the S&P 500.

However, bear in mind that strong economic releases can also lead to an increase in future inflationary expectations, which in turn can have a negative impact on share prices and the S&P 500. Fundamental analysis boils down to finding a balance and identifying what themes are currently ruling the markets.

Individual company performance

The performance of individual companies is another factor that can influence the S&P 500. Companies that have a higher market capitalization and a larger weighting in the index are capable of moving the price of the S&P 500.

It’s useful to follow the performance of the largest index constituents by index weight. As of February 2022, those are Apple Inc., Microsoft, Amazon.com, Facebook, Alphabet, Tesla, and Nvidia.

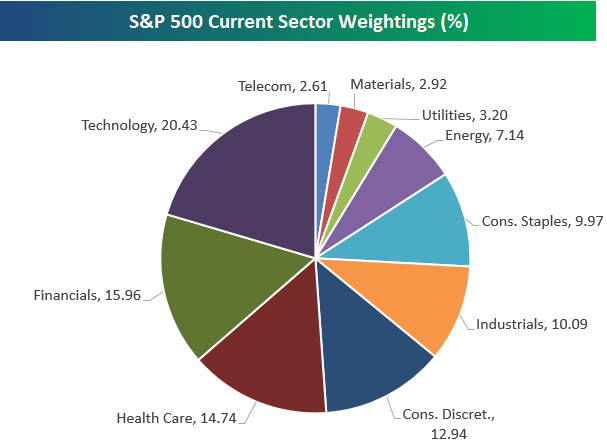

Besides individual company performance, sector performance can also affect the S&P 500. Important sectors in the index include the pharmaceutical sector, technology, health care, financials, industrials, energy, consumer staples, materials, real estate, utilities, communications, and the consumer discretionary sector.

Socio-political events

Important events like economic recessions, pandemics, and political turmoil can all have a significant impact on the S&P 500. The Great Recession of 2007/2008 caused a sell-off in the stock market, causing the S&P 500 to plummet more than 50% from October 2007 to April 2009.

While those events may sound scary to the average trader and investor, those are often the best times to invest in the market and buy while prices are extremely undervalued. As the investment adage goes: buy when everybody is fearful and sell when everybody is greedy.

How to trade the S&P 500

There are many ways to get exposure to the S&P 500 index, like CFD trading, futures contracts, options, and individual stocks and ETFs. Each of them has its own advantages and disadvantages, which are explained further below.

S&P 500 CFDs

CFDs, or Contracts for Difference, are financial derivatives that are designed to track the price of an underlying asset. In the case of S&P 500 CFDs, those contracts track the price of the S&P 500.

CFDs are an extremely popular trading vehicle as they usually come with attractive leverage ratios and the ability to short-sell the market. Leverage allows you to dramatically increase your buying power with funds borrowed from your broker while allocating only a small portion of the position size as collateral for the loan.

Short-selling, on the other side, allows traders to profit from falling prices in the S&P 500. If your analysis shows that the index has formed a temporary peak (e.g. the Fed discusses monetary tightening), you could short-sell S&P 500 CFDs and make a profit as the price falls. Short-selling can also be combined with leverage.

S&P 500 futures

Futures contracts are agreements between a buyer and a seller to exchange an asset at a pre-specified price on a set expiry date. S&P 500 futures are traded on the Chicago Mercantile Exchange (CME) and are available in several different sizes.

The SP futures contract is a full-sized contract, the E-mini S&P contract (ES) is one-fifth the size of the SP, and the Micro E-mini futures contract is one-tenth the size of the E-mini S&P contract. Futures can also be traded on leverage, although the leverage is usually much lower than with CFDs, and trading commissions are higher.

S&P 500 options

Another popular way to trade the index is with options. Options are contracts that give the buyer the right, but not the obligation to buy an asset at a pre-specified price on or prior to a set expiry date. For the right, the buyer has to pay a small commission fee.

Options on the S&P 500 are based on futures contracts that track the benchmark index and settled for cash instead of the actual delivery of the constituent stocks. They are traded on the Chicago Board Options Exchange.

S&P 500 stocks and ETFs

Finally, traders can replicate the exposure of the S&P 500 by buying individual stocks that constitute the index. Needless to say, this is the most time-consuming and cost-intensive way of trading the S&P 500, and should only be done if there are good reasons to do so (such as changing the weightings of individual companies, for example.)

A better way to invest in and trade the index would be buying ETFs that track the index. ETFs, or exchange-traded funds, are designed to replicate the entire S&P 500 and its constituent companies, including their weightings in the index.

ETFs are traded on the stock exchange just like regular stocks and come in a variety of flavors, such as S&P 500 technology ETFs, financial ETFs, high-dividend ETFs, and more.

What are the S&P 500 trading hours

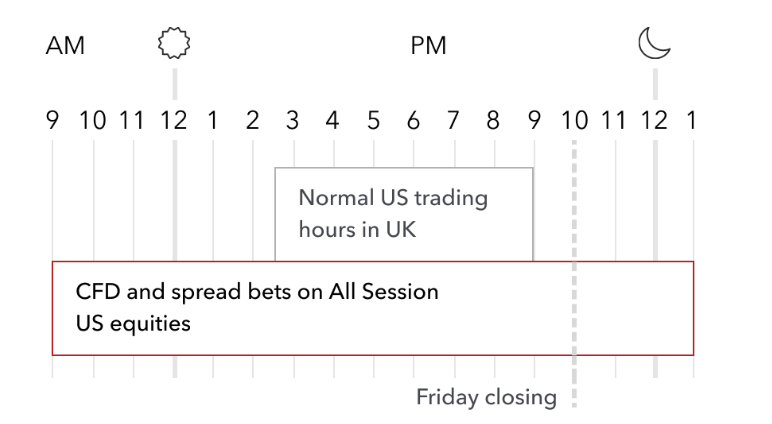

The S&P 500 follows the regular market hours of the stock exchange, that is, from 9:30 am to 4 pm EST (2:30 pm to 9:00 pm GMT) on weekdays. Some brokers also offer pre-market trading on the S&P 500 that starts as early as 4:00 am EST (9:00 am GMT), and can extend to 8:00 pm EST (1:00 am GMT) on after-hours sessions.

Fundamental and technical analysis to trade S&P 500

Traders who trade the S&P 500 generally use fundamental and technical analysis in their research. Even though some traders prefer to solely focus on technical analysis, the best results are usually achieved by combining both fundamentals and technicals in trading.

Using fundamentals to trade S&P 500

Fundamental analysis refers to economic data and models that are designed to identify overvalued and undervalued market conditions. The data can then be used to make informed decisions on whether the S&P 500 has a higher chance to rise or fall in the future.

Fundamental analysis includes tools such as economic calendars, unemployment rates, inflation rates, monetary policy decisions by the Fed, retail sales, GDP growth, and business and consumer confidence indices.

As mentioned earlier, monetary policy decisions by the Fed are the most important fundamental event that can have a huge impact on the S&P 500. In making their decision, the Fed takes into account publicly-available information in the form of economic indicators, including inflation rates and economic growth.

Changes in the monetary policy and interest rates can lead to a move of the capital from equities to bonds, which in turn impacts the price of stocks and the S&P 500. Traders who want to incorporate fundamental analysis in their decision-making should always keep an eye open on important economic releases and Fed meetings.

Taking advantage of technical analysis

Technical analysis refers to the usage of historical price patterns in the analysis of price charts. The basic premises of technical analysis are based on the assumptions that history tends to repeat itself, the price discounts all available fundamental data, and that markets like to trend.

The best trading opportunities are usually found at the intersection between fundamentals and technicals. This means, try to use fundamentals to predict the possible direction of the market (up or down), and technical levels to identify appropriate prices where to enter or exit the market.

Once you’ve identified an important fundamental driver that may have an impact on the S&P 500, you can use technical analysis to find appropriate entry and exit levels in the market based on support and resistance areas, Fibonacci retracements, or trendlines.

Some useful technical tools to trade the S&P 500 include:

- Chart patterns: Head and shoulders and inverse head and shoulders patterns, double and triple tops and bottoms, rising and falling wedges, rectangles

- Trend analysis: Trendlines and channels, and Fibonacci retracement levels (such as the 38.2%, 50%, and 61.8% ones)

- Technical indicators: RSI, MACD, Bollinger bands, ADX, Stochastics, and the Average True Range (ATR)

Tips for trading the S&P 500

- Always use stop-loss orders when opening a trade in the S&P 500. This helps prevent large and unexpected losses.

- Never scale into losing trades. If a trade goes in your favor, consider adding to the position at favorable technical levels (such as pullbacks.)

- Always manage your risk and actively monitor your open trades. Don’t risk more than 2% of your account on any single trade.

- Follow economic calendars and try to avoid trading around high-volatility events, such as non-farm payrolls or FOMC meetings.

- Develop a well-defined trading plan and always stick to your rules. Even when things don’t go in your favor at times.

- Keep a trading journal with all of your trades, their entry and exit prices, performance, and reasons for entering the trade. Review your journal periodically to identify repeating mistakes in your trading.

Why trade S&P 500 with Swift Expert Trades

Swift Expert Trades is an award-winning broker that offers CFD trading on a variety of asset classes, including stocks and stock indices, forex, metals, energy, and cryptocurrencies. The broker’s trading platform, with its intuitive user interface and advanced charting tools, caters to both beginner and seasoned traders.

Trading S&P 500, known as SP500 at Swift Expert Trades, CFDs with Swift Expert Trades allows traders to utilize the full power of leverage, which means that even small price movements in the index can lead to magnified trading results. The broker features attractive leverage ratios to turbo-boost your market exposure, even with small trading accounts.

Traders are also able to benefit from falling prices in the S&P 500 with the help of short-selling. If your analysis shows that the price of the index may drop, simply hit the “sell” button and Swift Expert Trades takes care of the rest. As the price of the index falls, you’re making a profit on your trade.

Can you invest in the S&P 500?

Any trader with a live trading account can invest in the S&P 500 (SP500) through CFDs, futures, options, or ETFs.

How do I buy an S&P 500 stock?

Getting exposure to the S&P 500 can be achieved in a variety of ways. The simplest and most versatile option is to use a CFD, as it allows margin trading and short-selling without having a set expiration date, like in the case of futures or options. To start trading S&P 500 CFDs, simply open a live trading account on Swift Expert Trades, complete your deposit, and start trading.

Does the S&P 500 pay dividends?

The S&P 500 is a free-float stock market index that tracks the performance of the largest publicly-traded US companies, many of which pay out a dividend. The historical dividend yield on the index has typically been around 5%.

How much money do I need to invest in the S&P 500?

The minimum deposit to start trading on the S&P 500 on Swift Expert Trades is 0.001 BTC. The account opening process is simple, fast, and straightforward.

Is it good to buy S&P 500 now?

The S&P 500 has seen an average annual return of around 7% since 1950. However, the best time to buy S&P 500 depends on your personal trading style and plan.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Swift Expert Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Swift Expert Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.