After crashing on Monday due to high-spreading Omicron cases, stocks rebounded strongly after it was stated that Omicron victims experience only mild symptoms.

Financial data published on Thursday helped fuel the rally further, showing a strong economy with improving labour and spending trends. For example, jobless claims for the previous week came in about as expected at 205,000. Durable goods for November rose by 2.5%, compared to the 1.5% consensus estimate. Besides, personal income and spending showed increases compared to November, boosting investors’ risk appetite.

All three major US averages closed higher for the week with the Dow rising by 1.6%, and the S&P 500 adding about 2.3%. The Nasdaq rallied nearly 3.2% as investors reacted positively to the market figures after Omicron-led fears were deemed overestimated.

Meanwhile, trading volumes were thin due to the shortened week as the markets were closed for the Christmas holidays. This week will be alike with most institutional investors having closed their books or being on extended vacation.

Oil became one of the top gainers of the week and rebounded strongly on receding COVID fears, gaining close to 10%.

Just as last week, Silver and Gold also inched higher, with Gold finally closing the week above $1,800 – at $1,809. Silver closed at $23 after the USD dipped on Wednesday due to currency intervention from Turkey.

Unlike most market players, after a month-long slide Turkish Lira had plunged to an all-time low of 18.4 per dollar due to unorthodox interest rate cuts and fears of an inflationary spiral. However late on Monday President Tayyip Erdogan unveiled a scheme in which the Treasury and central bank would reimburse losses on converted Lira deposits against foreign currencies, especially the USD. The announcement sparked the currency’s biggest intraday rally against the USD – Turkish state banks were rumoured to have heavily dumped the currency in support of Erdogan’s scheme.

With risk-on sentiment back on track, cryptocurrencies also rebounded strongly with altcoins leading the market with double digit percentage. Meanwhile, BTC managed to jump up by 6% mid-week after the USD slump ushered it back to flirt with the $50,000 mark.

BTC Bounced As Short Positions Closed Ahead of Christmas Holiday

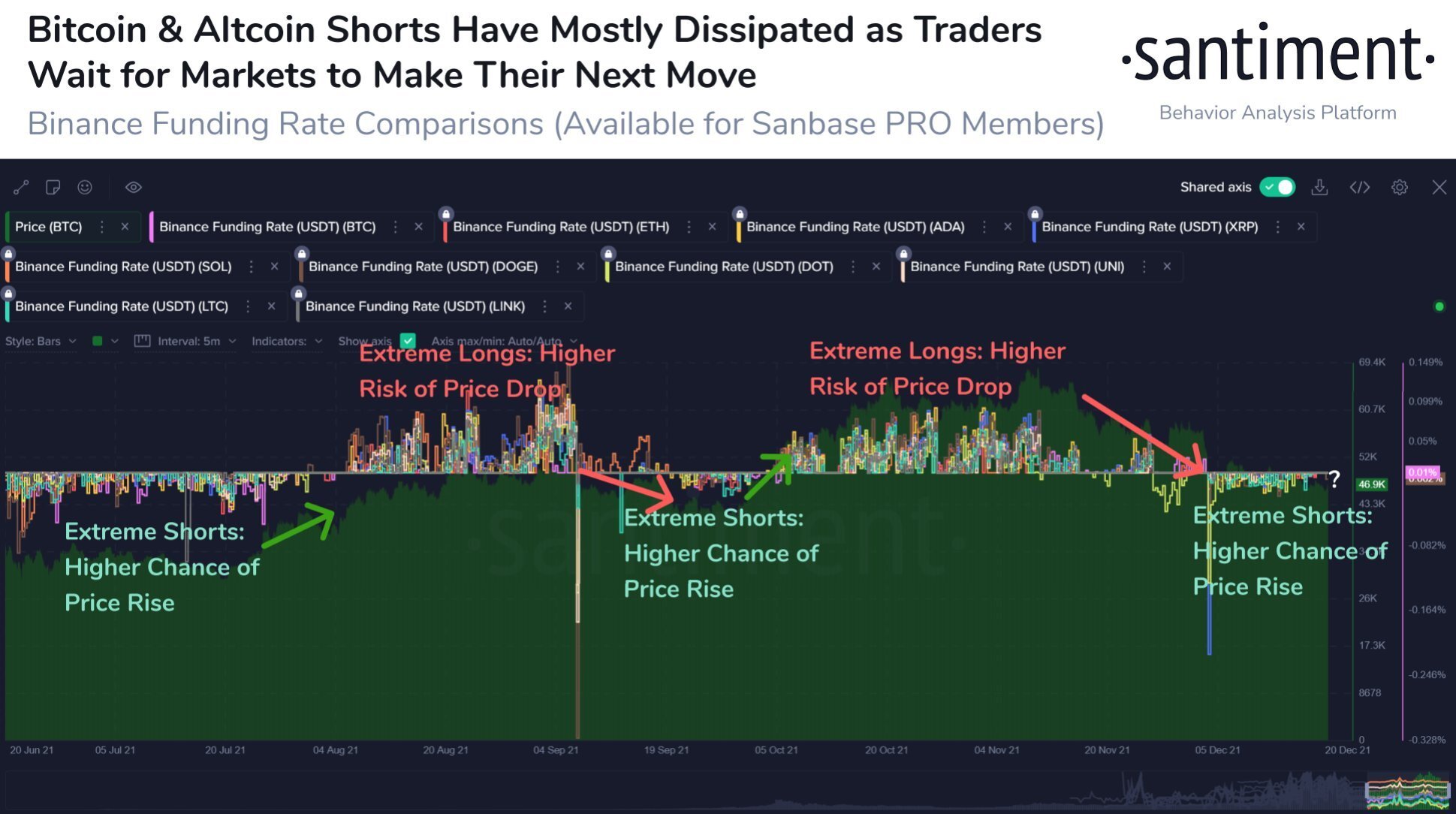

The start of last week showed funding in negative territory, with traders preferring short positions, hoping for the BTC price to fall further for a significant potential profit. However, as most traders know from experience, if funding rates continue to be negative for an extended period of time, prices are very likely to rise as buyers could squeeze the shorts to close their positions.

And indeed, helmed by positive sentiment surrounding the improving situation in Turkey, the BTC price jumped 5% overnight on Tuesday hitting above $49,000. It continued to inch higher in the days ahead where it hit as high as $51,800 on Christmas Eve, giving BTC investors a reason to cheer about during holidays.

To celebrate it further, El Salvador announced that it bought another 21 BTC on Tuesday to mark the 21st day of the last month of the 21st year of the 21st century. President Nayib Bukele claimed the purchase was made at 21:21:21, and pointed out that El Salvador’s land area is 21,000 square kilometers.

However, as typical for quick bounces, BTC started to lose some gains during holiday weekend, and could continue to consolidate on thin volume this week as most institutional investors are on vacation.

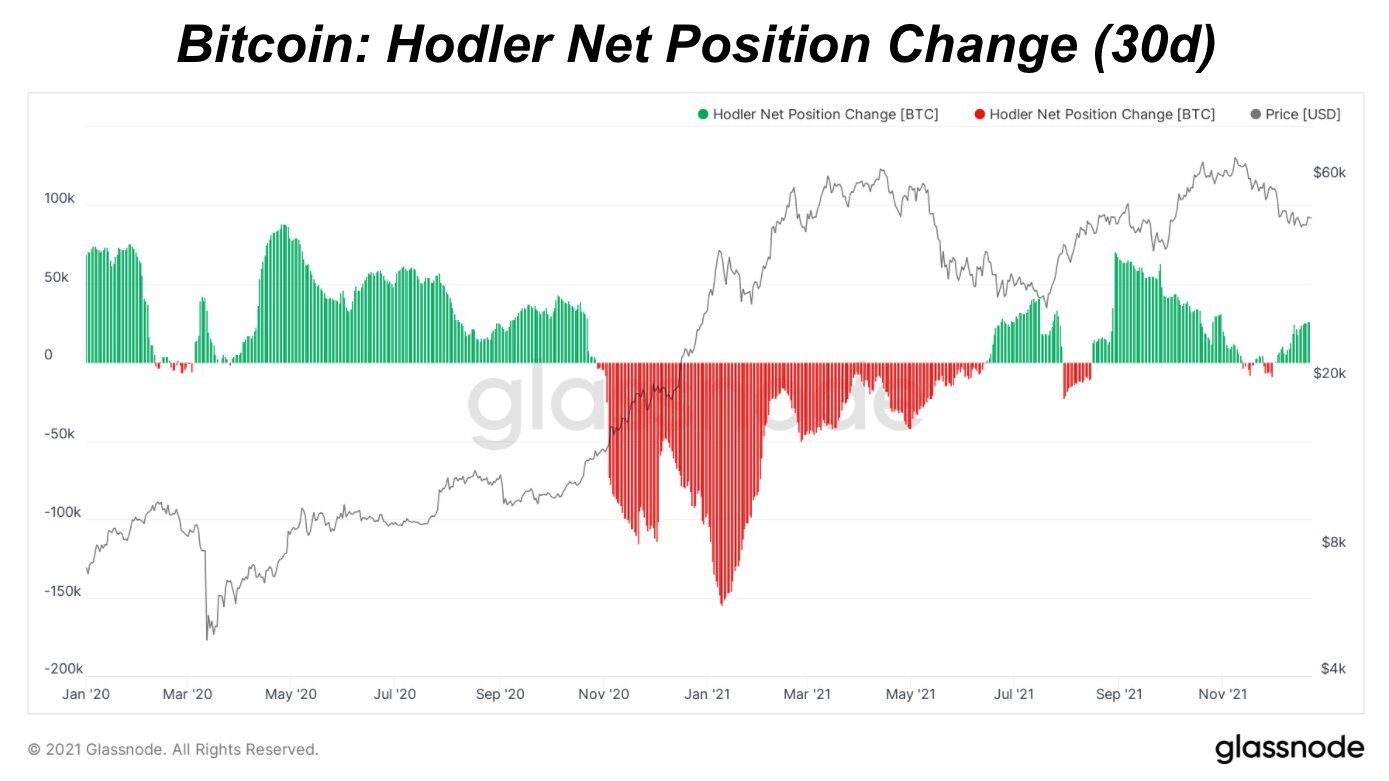

BTC Buyers Continue To Accumulate Without Selling

However, the price of BTC may not retrace a lot since even in thin year-end trading, as buyers who hold the coin for more than 30 days continue to accumulate BTC on a stable basis, as shown by the diagram below.

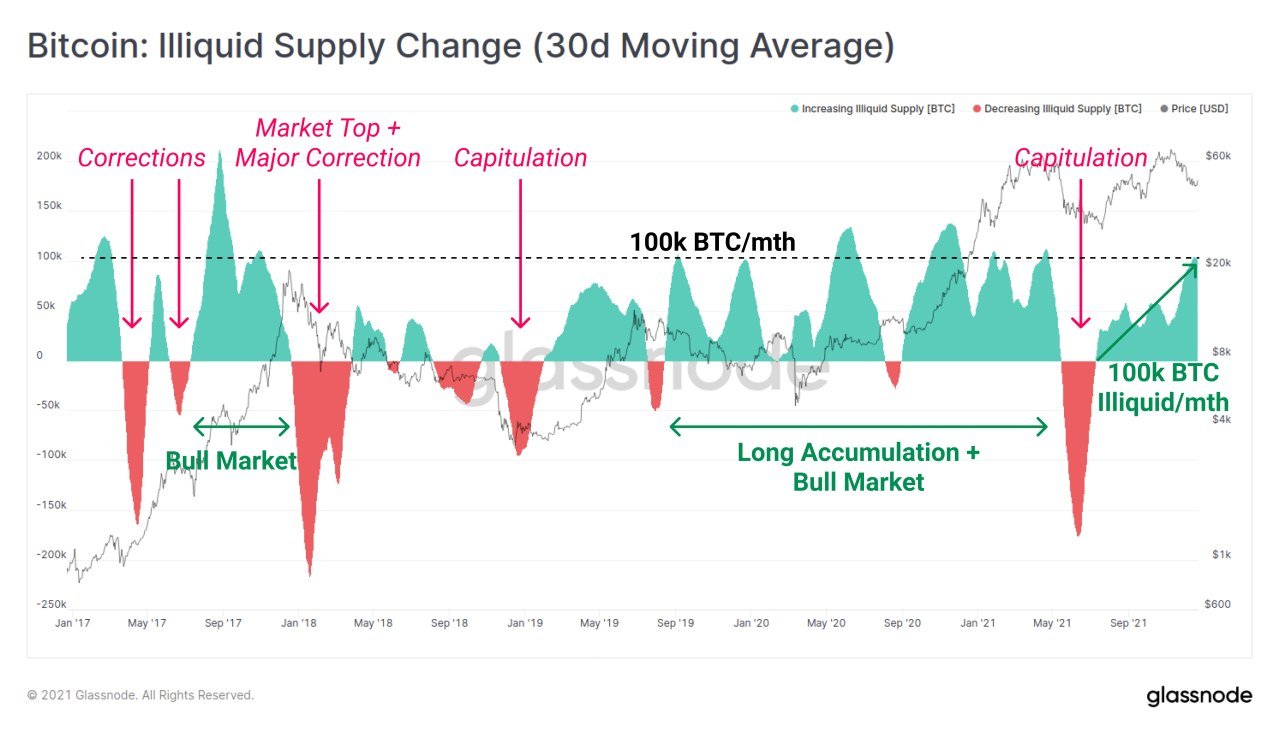

Moreover, while buyers accumulate the coin without selling, the illiquid BTC supply has been growing at an increasing pace. The supply change from liquid to illiquid has grown to 100,000 BTC per month in December. To clarify, Illiquid supplies consist of coins sent to an address with little history of spending, the process generally associated with long-term investor accumulation.

While the number has been rising since September, the illiquid supplies rose significantly in December as seen in the diagram below.

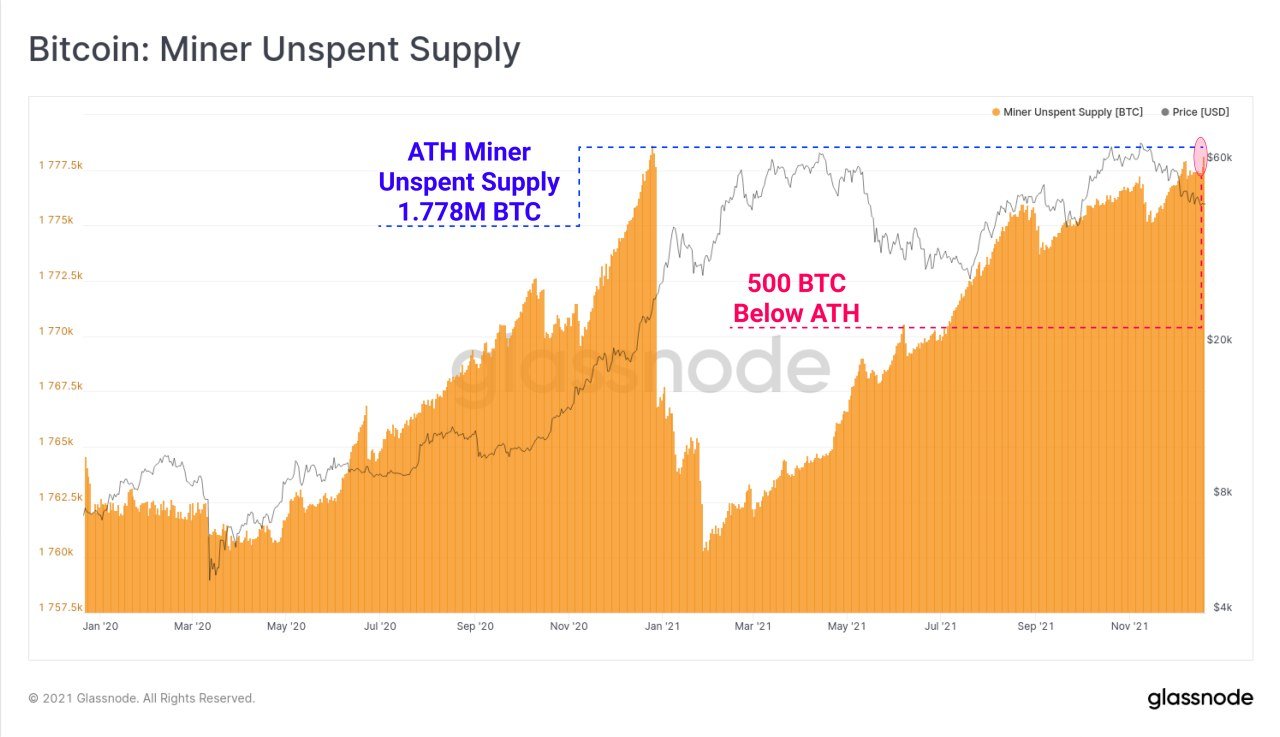

BTC Miners Unspent Supply At ATH

While BTC does have a steady stream of accumulating buyers, it does not seem to have many active sellers. Even miners, who traditionally need to sell BTC to fund operations, have not been operating since the price fell below $60,000. Miners’ unspent BTC supply has also seen an upgoing spike in the past few days, taking the figure to an ATH – 1.778 million BTC. In other words, miners are now hoarding the highest amount of BTC in history.

Not only is it a proof of miners’ optimistic mood for higher prices ahead, it also obviously implies that the selling pressure is declining.

It is interesting to note that the amount of BTC held collectively by miners is now larger than the cumulative amount of BTC reserve held at exchanges.

According to the data, only around 1.3 million BTC is held on cryptocurrency exchanges, which is much less than 1.778 million BTC owned by miners. This 1.3 million is also the lowest amount of BTC stored on exchanges this year, representing less than 6% of BTC issued supply. Moreover, the seven-day moving average for BTC’s exchange inflow volume has also reached a five-month low of 978.452 BTC and has been trending down on a weekly basis. In other words, the BTC flow to exchanges is slowing down and could further worsen the supply shortage. BTC supply shock is intensifying and the coin is getting scarcer by the day, resulting in a grand news for BTC bulls.

As positive on-chain data has been reinforced by BTC bullish price action, as optimism is rising amongst hedge funds. Data from derivatives exchanges showed that funds were getting more bullish when BTC price hit mid-$50,000 in January. One of the large funds claimed to buy a chunk of call options with mid-Jan expiry showing a strike price between $52,000 to $56,000.

Taxes On Investors’ Minds As Year Draws to a Close

After BTC showed signs of brighter future, altcoins rebounded nicely with LUNA becoming the star performer carving out a new ATH on Christmas Eve and TVL continuing to rise on its blockchain. ETH has also managed to climb above $4,000, albeit still lacking compared to many altcoins and even BTC in terms of percentage gains. However, holders of ETH need not fret as the upcoming Merge in 2022 would bring lots of hype and volatility would certainly spike again with the ETH transition from PoW to PoS nearing.

Currently, market participants are not considering short-term trading profits as the year comes to a close, while matters that are of interest to most traders are primarily related to paying taxes.

Social media mentions of tax related subjects have been hogging the bandwidths, compared to profit-related words which are usually the most widely mentioned. Which is not surprising, as investors are generally not interested in trading as usual because they are consolidating their financial positions. However, this reflective mood may change after we rush into the New Year in the following week.

DOGE Announces Staking Program on Christmas Eve

After the Tesla news prompted optimism among DOGE holders, the Dogecoin Foundation made another positive announcement that could keep the excitement going for DOGE supporters. The Foundation said that it is working in collaboration with ETH co-founder Vitalik Buterin on a staking mechanism for DOGE.

Part of the Dogecoin Trailmap released by the Foundation last Thursday included a works-in-progress development on building a “uniquely Doge proposal” for a “community staking” version of proof-of-stake (PoS) altcoin. Such a version would allow all DOGE users to stake their assets and get extra tokens for supporting the network. It has been the main disadvantage of the DOGE’s PoW consensus mechanism which has left it trailing behind other popular PoS blockchains allowing staking to lock up supplies of the respective tokens. Once the program sets off, the long-standing issue of DOGE having a large and growing supply could be resolved, bringing new hopes of price recovery from its more than 70% crash since May 2021.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Swift Expert Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Swift Expert Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.