Uniswap is just one of many new automated market maker platforms offering liquidity pooling and token swapping through a decentralized exchange interface. These new, innovative platforms have been encroaching on centralized exchanges that have long been the primary option in the cryptocurrency market.

Uniswap has become incredibly popular in a very short amount of time and recently introduced the UNI token to the earliest users of the swap protocol. Much of the popularity behind the platform is due to the fact that it is easy for developers to launch new tokens and projects to attract early investors for liquidity provisioning. Unlike ICOs, new tokens born this way are more sustainable and offer additional promise. There is also no listing process, no listing fees, and is available to all who contribute liquidity to the platform.

Here’s why Uniswap and platforms like it have exploded in popularity alongside the rest of the booming decentralized finance applications driving substantial ROI in the cryptocurrency space.

What Is Uniswap? All About The Automated Market Maker Protocol

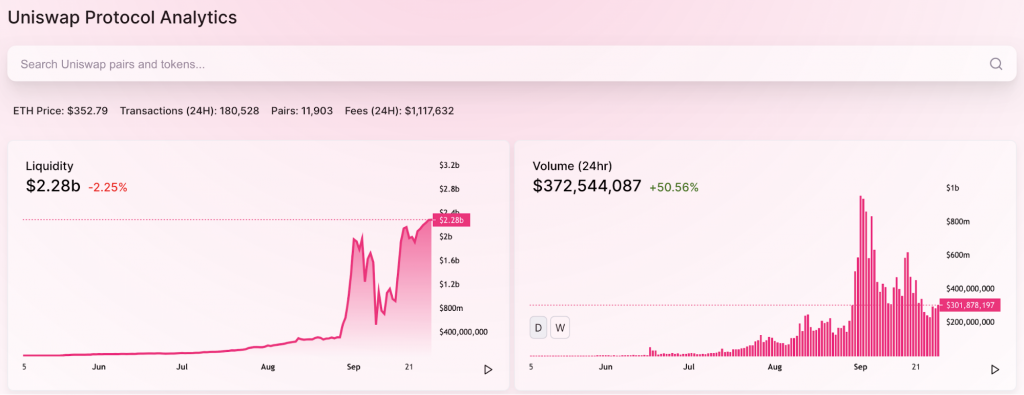

Uniswap is an open-source software swap protocol that is built on Ethereum-based ERC-20 smart contracts, like many other decentralized finance applications. The surge in interest surrounding Uniswap and the DeFi space has propelled Uniswap as the most dominant DeFi app in terms of total Ethereum locked up.

Users swap ETH and other tokens from an Ethereum-based wallet connected to the Uniswap platform. Because Uniswap is open-source software like Bitcoin and many other crypto projects, users can view the code on GitHub.

Uniswap offers an easy to use, visual interface for a decentralized exchange designed to swap ERC-20 tokens over the Ethereum protocol. The platform’s algorithm is designed to automatically match buyers and sellers through swapping, smoothing out order book depth, and making for a more straightforward swapping process.

Although Uniswap was created in 2018 by Hayden Adams, it only recently gained popularity during the sudden burst of enthusiasm and interest surrounding DeFi applications and tokens. Investors were making a fortune automatically swapping tokens over Uniswap, SushiSwap, and other swap protocols, ultimately resulting in the launch of the UNI token to give users certain governance rights over the protocol along with the ability to yield farm for more UNI.

The UNI token launch, essentially giving users 400 free tokens valued anywhere from $2 to $7 during the first few days of launch, caused yet another enormous wave of buzz and interest surrounding the platform.

How Uniswap Works And How To Connect And Ethereum Wallet

Uniswap works by connecting an Ethereum-based wallet to the decentralized finance application and liquidity pooling protocol.

Once an Ethereum wallet is connected, either through Metamask, Coinbase Wallet, or any other compatible wallet for ERC-20 tokens, users can directly swap tokens from one to another. Whatever the asset’s price is at the time of the swap, determines the pricing. Traders are switching tokens back and forth, hoping to extract a profit from the price fluctuations in between, while investors seek access to early tokens and hold them in hopes of them rising enormously in value.

Several DeFi tokens have exploded in value over the last year, helping to cause the decentralized finance trend to catch fire. Yearn.Finance, for example, is now more valuable than Bitcoin itself.

Understanding The Difference Between Uniswap V1 and V2

Uniswap launched as a V1 “proof of concept” version, and later was upgraded to V2 for greater security and a host of other benefits. However, some users still rely on V1 and V2 is still considered a beta. A V3 is said to be coming eventually. Here are the key differences between the two currently available versions of Uniswap.

V2 is written in Solidity code instead of Vyper and is compatible with ERC777 and other non-standard ERC20 tokens, unlike V1. V1 also only let users swap between ETH and a single ERC-20 token, while V2 relies on Wrapped ETH (WETH) to enable pools of any ERC20 token directly with another.

V2 lets users flash swap to withdraw tokens at no upfront cost. It also relies on price oracles and is far more reliable and manipulation-resistant than V1. V2 also introduced the framework for self governance through the UNI token.

How Are Uniswap (UNI) Tokens Produced

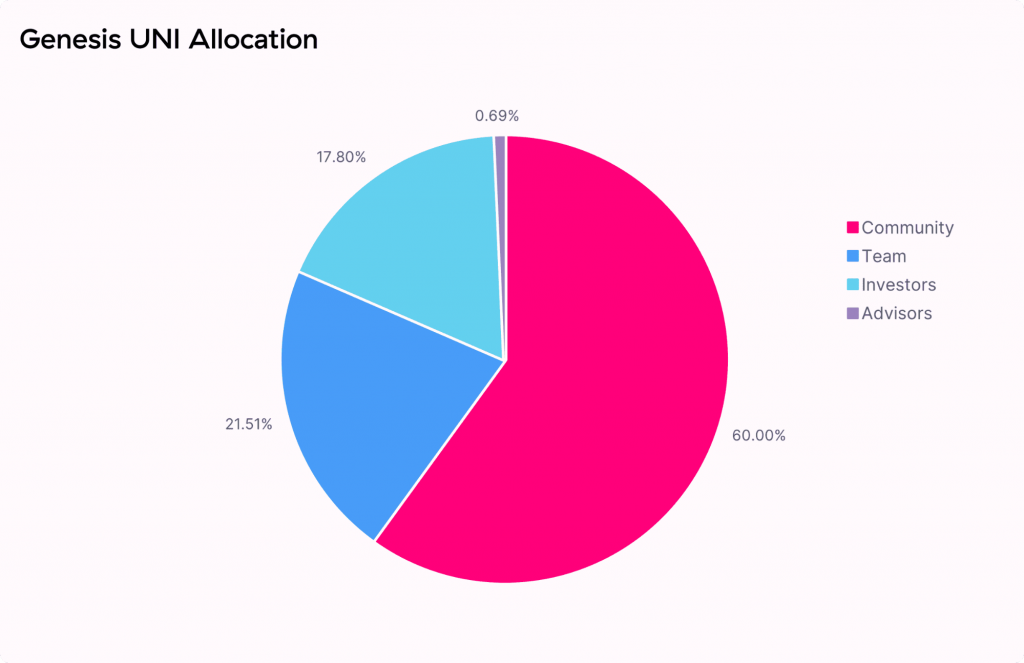

Uniswap tokens were produced as ERC-20 tokens and distributed to the community via a highly popular airdrop program. Early users got 400 tokens each, while the rest of the distribution breaks down as follows:

- 15% via community airdrop and early user giveaway

- 2% to liquidity mining

- 43% to the Uniswap governance treasury

- 21.51% to Uniswap team founding members and reserves for future employees

- 17.80% to early VC investors and other stakeholders who funded Uniswap

- 0.69% to Uniswap board advisors

The total Uniswap supply is 1 billion UNI.

Users who used the platform early are able to claim a free 400 UNI by connecting the original wallet they interacted with the platform with, and the 400 UNI will be waiting to be claimed. Just be certain to keep some Ethereum in the wallet you are using to pay for any ETH gas fees associated with moving the UNI. You can also swap the UNI immediately on the platform for another token.

How Does Uniswap Pools Work?

Automated market makers like Uniswap are smart contracts that hold liquidity in pools. Liquidity providers launch markets by depositing a matching value of two tokens, typically ERC20 tokens, stablecoins, or ETH. Liquidity providers are given liquidity tokens representing their share in the pool. These tokens can later be swapped out for the share they represent of the pool.

If the pool is designed for ETH/UNI and UNI is swapped out for another token, the UNI in the pool is decreased, causing the price of UNI to rise to automate pricing. The larger the liquidity pool, the larger the orders it can handle without driving prices up. However, the opposite is true for smaller pools, which can cause for expensive larger sized orders.

How Do You Add Liquidity To Uniswap?

Adding liquidity is very simple, and there are a number of ways to do so.

- Uniswap is an ERC-20 smart contract platform built on Ethereum, so the easiest route to add liquidity is by obtaining Ethereum and adding it to an Ethereum wallet.

- The Ethereum wallet must be compatible with the Uniswap platform, such as Metamask or the Coinbase Wallet.

- These wallets allow connections with decentralized applications like DeFi platforms such as Uniswap.

- Tokens can be swapped right from the wallet itself, all while maintaining ownership over the private keys and tokens.

- Any ETH or other ERC20 tokens or stablecoin crypto assets can be added to liquidity pools or swapped for other tokens.

How Do You Remove Liquidity From Uniswap?

Removing liquidity is just as easy and involves the same methods and wallets involved with adding liquidity in the first place. The key is to remove liquidity while the price is higher than the value of the token liquidity initially provided.

- Once the token you want to remove for liquidity is selected, either move that token out, swap another token for it, then it is immediately available within the Ethereum-based wallet.

- From there, the token, Ethereum, or whatever you changed for can be sent anywhere else or to another wallet.

- It also can be stored in the wallet for safe-keeping. Since you own the wallet related to accessing Uniswap, there is no fear of any exchange being hacked.

- Still, there is risk associated with Uniswap.

Providing Liquidity On Uniswap: How To Profit?

We now know that you add liquidity by connecting an Ethereum wallet and pooling liquidity into the various liquidity pools available. The tokens added increase the liquidity in the pool, causing the price per token to lower. Tokens removed decrease liquidity and cause prices to rise. The key to profiting is being on the right side of the timing related to adding and removing liquidity. Since you aren’t buying to buy high or selling to sell low, you really are just looking to swap at the best prices possible with the largest positive gaps in between.

Uniswap Risks

But because Uniswap and other automated market maker protocols don’t behave like other traditional centralized exchanges, how to profit and what the risks are aren’t as straightforward. Swapping at the wrong time can wipe out gains, especially if the market tanks. For example, farming UNI by pooling ETH tokens could cause a deep price fluctuation if the cryptocurrency market crashes. Larger tokens like Ethereum hold up better than smaller ERC-20 tokens. A crash in these other tokens could result in receiving a smaller sum of Ethereum when its time to swap out, and the Ethereum itself will have fallen in value as well, amplifying losses.

Conclusion: Why Risk It All With Uniswap When swiftexpertrade Is Here?

Since there is such potential to risk funds with Uniswap, users may be better served by trading cryptocurrencies and traditional assets on swiftexpertrade, using CFDs offering long and short positions, stop loss orders and all the risk management tools that liquidity pooling protocols just do not provide.

Registration is fast, easy, and requires just a 0.001 BTC deposit to get started. Ethereum is also included on the platform, so there’s no need to miss out on the asset central to the entire DeFi movement, without risking it on new tokens via Uniswap.

For those that cannot resist the allure of Uniswap and all it has to offer, this guide has at least prepared you for all the potential pitfalls and profits you could possibly make by using the popular DeFi platform. But remember swap at your own risk.

Is Uniswap A Wallet?

No, however, it allows you to interact with its protocol using an Ethereum-based wallet app or services such as MetaMask, Coinbase Wallet, and countless others. Using one of these wallets, users can interact with the Uniswap smart contract and swap ERC20 tokens, stablecoins, UNI, ETH, and even Ethereum-wrapped Bitcoin (WBTC) over the platform.

What Is Uniswap In Crypto?

Uniswap is a platform where new decentralized finance tokens are launched and traded by a new generation of liquidity pool providers. These are essentially traders and investors, using buzzworthy new terminology and technology to build the future of DeFi. Uniswap in crypto is also the UNI token itself, which is named after the Uniswap protocol it is used for governance over.

What Is A DEX?

DEX is short for decentralized exchange. Cryptocurrencies like Bitcoin were designed to provide users with ownership and control over the asset, but this also makes users chiefly responsible for custody or forces users to send crypto assets to exchanges that hold the private keys for you. Decentralized exchanges, however, are built as smart contracts and function by interacting directly with Ethereum wallets. The exchange launches as Dapp within a Dapp browser in the wallet app or via the web by connecting Meta Mask and letting users trade assets the same way that is possible at a traditional exchange.

Does Uniswap Have A Token?

Yes, as of September 2020, Uniswap launched its UNI token to the crypto world and reignited the interest in the DeFi space. 400 UNI tokens could be claimed from users who interacted with the platform before September 1, 2020.

How Do I Use Uniswap?

Anyone can use Uniswap by buying Ethereum, loading it into an Ethereum-based ERC20 token wallet, and launching the application or website. Once the wallet is connected to the Uniswap interface, the instructions are reasonably clear, and in just a few clicks, you can swap one token for another.

How Does Uniswap Make Money?

Once a swap has been made, just like trading any asset, you can then swap the token back for another token or the original investment, hoping to turn a profit from the price fluctuation that takes place due to the overall liquidity in each pool changing dramatically for whatever duration. However, there is also risk of substantial loss using such a strategy, as pricing isn’t always transparent, liquidity can vary rapidly depending on order size, and transactions can fail, spending ETH for no reason at all.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of swiftexpertrade. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. swiftexpertrade recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.